golf equipment.

Golf Equipment & Simulator Financing

Primary program for retail golf products and golf carts

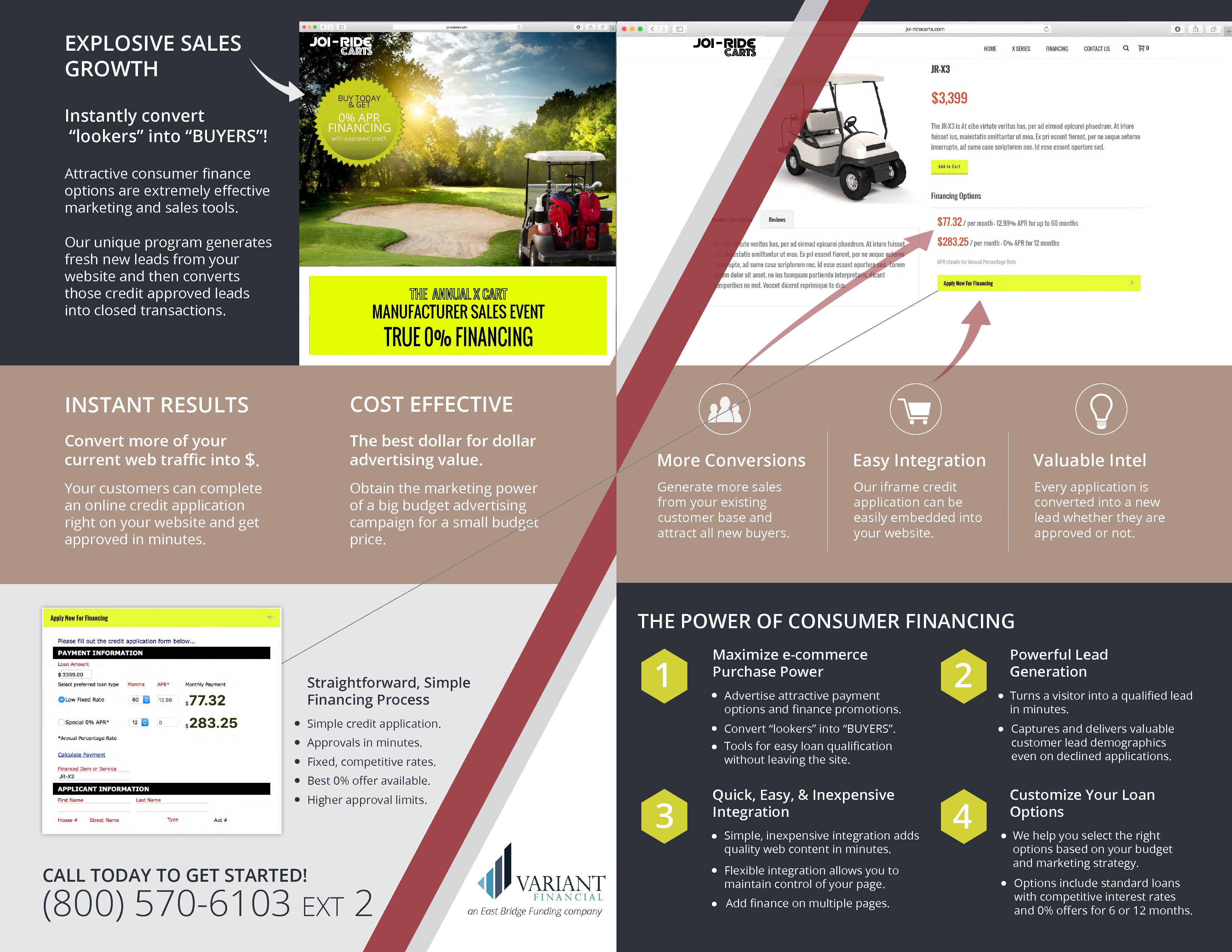

Variant’s retail goods financing program for the golf industry is unique and extremely effective. It allows online and brick and mortar golf retailers to advertise great financing promotions such as 0% FINANCING AVAILABLE both on their websites as well as in their store windows. We also offer financing terms with competitive interest rates for up to 60 months

Customers can apply for financing right on the retailer’s website or in the store via a simple credit application. The customer chooses between a low, fixed-interest monthly payment, or a 0% APR offer for 6 or 12 months. After completing the application, a decision is immediately returned. The customer can then sign the loan document electronically and take possession of the item they are purchasing or the merchant can ship the product in the event of an online sale.

Retailers are generally funded in 24 to 48 hours on a non-recourse basis. Merchant fees start as low as 1.99% which is lower than most visa or master card transaction fees.

The program is a primary program and will consider FICO scores from the mid 600’s and above.

The financing can be used for selling products such as golf carts, golf simulators, high end clubs, and other related equipment costing $850 or more.

Variant has brought to market multiple customer financing programs for various facets of the golfing industry. We currently offer primary and sub-prime consumer financing programs for use in selling retail goods from golf carts to golf technology as well as educational products like golf seminars and training. Financeable products and services have retail costs of $500 to $20,000 or more and can be sold both online and in store (brick and mortar).

Get more

Custom Program for golf training and education

In addition to golf equipment, Variant finances golf instruction and training programs. See our career training financing program page for more details.

Minimum Annual Revenue (Total Sales)

$500,000

Minimum Years in Business

1

Business Background

– Profitable

– No Bankruptcy

Principals Background

– Reasonable Credit

– No bankruptcy

– No foreclosure

– No Tax Liens

Cost Effective

Obtain the marketing power of a big budget advertising campaign for a small budget price.

Easy Integration

Unmatched Promotions

True 0% Interest Financing

Lead Generation

Even the declines can be converted into sales as you are provided with the contact information for the interested customer.